Sequence-of-returns risk quietly threatens your early retirement by making your savings dwindle faster if market downturns happen when you start withdrawing funds. Even with good overall returns, poor timing can deplete your money prematurely, especially during market lows. Recognizing these risks helps you develop strategies like diversification and flexible withdrawals to protect your savings. Stay alert to market shifts—understanding this risk can be the key to securing your retirement goals, so explore how to minimize it further.

Key Takeaways

- Sequence-of-returns risk occurs when poor market timing early in retirement depletes savings faster than anticipated.

- Early negative returns can erode the portfolio, making it difficult to sustain withdrawals over time.

- Even with strong overall returns, adverse sequencing can cause premature depletion of retirement funds.

- Lack of flexible withdrawal strategies amplifies the risk, leading to potential early retirement failure.

- Diversification, cash reserves, and adaptive planning are vital to mitigating this silent yet critical risk.

What Is Sequence‑Of‑Returns Risk and Why Is It Critical?

Sequence-of-returns risk is the danger that the order of investment returns can markedly impact your retirement savings, especially during withdrawal years. When market volatility causes declines early in retirement, your withdrawal strategies can be severely affected. If you start withdrawing funds during a market downturn, your savings may shrink faster, reducing the longevity of your nest egg. This risk isn’t about the total return over time but about the sequence in which returns occur. Even with good overall performance, poor timing can deplete your funds prematurely. Recognizing this helps you develop more resilient withdrawal strategies, such as maintaining cash reserves or diversifying investments, to mitigate the impact of market volatility and protect your retirement income. Understanding the importance of diversification and its effects can also help in planning your investment withdrawals more effectively. Additionally, implementing supportive retirement planning techniques can further safeguard against this risk.

How Market Fluctuations Early in Retirement Can Wipe Out Savings

When market fluctuations happen early in retirement, they can have a profound impact on your savings. A sudden downturn reduces your portfolio’s value just as you’re starting to withdraw funds, risking depletion of your nest egg. The inflation impact compounds this challenge, eroding purchasing power and forcing you to withdraw more to cover expenses. Additionally, tax considerations can amplify the damage; withdrawing funds from tax-advantaged accounts during a market dip may lead to higher taxes later or force you to sell investments at a loss. These factors can considerably diminish your savings, making it harder to sustain your desired lifestyle. Early market downturns aren’t just temporary setbacks—they can threaten your entire retirement plan if you don’t plan for their potential impact. Incorporating innovative European cloud servers into your financial planning tools can help you analyze and simulate various market scenarios to better prepare for such risks.

How to Spot Sequence‑Of‑Returns Risk in Your Retirement Portfolio

You can identify sequence-of-returns risk by watching for signs like inconsistent market timing and unexpected fluctuations early in your retirement. Pay attention to your spending patterns—large withdrawals during downturns can substantially impact your savings. Recognizing these clues helps you adjust your strategy before market swings threaten your financial security. Additionally, monitoring your portfolio’s market volatility can provide early indications of potential risks, especially when combined with an understanding of sequence-of-returns risk and its effects on retirement longevity. Incorporating sound healing science into your financial planning can foster better decision-making during turbulent periods, ensuring your investments remain secure and free from unnecessary stress. Being aware of piercing care and hygiene practices can also help ensure your investments remain secure and free from unnecessary stress, as maintaining overall financial health is critical in mitigating risks associated with market unpredictability.

Market Timing Clues

Market timing clues can serve as early warning signs that your retirement portfolio might be vulnerable to sequence‑of‑returns risk. Pay attention to shifts in market sentiment, such as increased volatility or widespread pessimism, which often signal upcoming downturns. Economic indicators also provide valuable clues; slowing GDP growth, rising unemployment, or declining consumer confidence can precede market declines. When these signals align, it’s a sign that your portfolio could face challenging returns in the near future. Recognizing these clues allows you to adjust your strategy proactively, perhaps by reducing exposure to riskier assets or increasing cash reserves. Staying alert to market sentiment and economic indicators helps you better prepare for potential downturns, safeguarding your retirement nest egg against the silent threat of sequence‑of‑returns risk. Additionally, monitoring wave and wind patterns in the market can further enhance your ability to anticipate shifts and adapt accordingly. Being aware of digital literacy and how it impacts access to financial information can also play a role in making informed decisions during volatile periods. Moreover, understanding the importance of market cycles can help you identify optimal times to reallocate assets and reduce potential losses.

Retirement Spending Patterns

Monitoring your spending patterns in retirement can reveal early signs of sequence-of-returns risk. If you notice fluctuating retirement spending that depends heavily on market performance, it could signal vulnerability. Rigid withdrawal strategies, like withdrawing the same amount each year regardless of market conditions, increase your risk when markets decline early in retirement. Conversely, flexible withdrawal strategies allow you to adjust spending during downturns, protecting your portfolio. Pay attention to how you manage your withdrawals—sudden drops or consistent overspending can deplete your funds faster if poor market returns hit early. Recognizing these patterns helps you adapt your retirement spending to mitigate sequence-of-returns risk, ensuring your savings last longer and your retirement remains secure despite market volatility. Additionally, understanding sleep comfort and how your environment influences rest can help you stay resilient during stressful financial periods in retirement. A key aspect of resilience is maintaining a stable sleep environment, which can improve your overall well-being and decision-making during uncertain times. Incorporating mindful financial planning can further help you prepare for unexpected market downturns and reduce the impact of sequence-of-returns risk. Learning about market fluctuations and their effects on retirement funds allows you to better anticipate and respond to potential challenges.

Top Strategies to Protect Your Retirement From Sequence‑Of‑Returns Risk

Protecting your retirement from sequence-of-returns risk requires proactive strategies that can help cushion the impact of market volatility, especially during withdrawal periods. One effective approach is implementing tax-efficient strategies, such as Roth conversions or tax-loss harvesting, to minimize taxes and preserve more of your savings. Additionally, solid estate planning guarantees your assets are protected and efficiently transferred, reducing potential tax burdens on heirs. Diversifying your investments across asset classes can also help manage volatility, while maintaining a flexible withdrawal plan allows you to adapt to market fluctuations without depleting your resources prematurely. Incorporating proper power backup solutions ensures that your critical financial documentation remains accessible and secure, even during unexpected disruptions. Combining these strategies empowers you to create a resilient retirement plan, reducing the adverse effects of sequence-of-returns risk and helping ensure your financial security long-term.

Adjusting Your Withdrawal Approach to Minimize Risks

Adjusting your withdrawal approach is a crucial step in minimizing sequence-of-returns risk, especially during volatile market periods. To protect your savings, focus on tax-efficient withdrawals that help stretch your funds and reduce unnecessary taxes. By planning flexible spending, you can adapt your withdrawals based on market performance, withdrawing less when markets are down and more when they’re up. This approach helps prevent depleting your portfolio too quickly during downturns, supporting sustained income. Prioritizing tax-efficient strategies and remaining flexible with your spending ensures you can better weather market fluctuations and maintain your retirement plans. Additionally, understanding sequence-of-returns risk can help you develop a more resilient withdrawal strategy that safeguards your assets during unpredictable market cycles. Remember, a dynamic withdrawal strategy allows you to respond to market changes proactively, reducing the impact of sequence-of-returns risk on your financial security.

Tools and Tips to Safeguard Your Retirement Goals

Using the right tools and strategies can substantially enhance your ability to meet retirement goals despite market uncertainties. Tax planning plays a pivotal role—you can optimize your withdrawals by utilizing tax-advantaged accounts and managing taxable income, helping your savings last longer. Additionally, consider estate considerations; proper estate planning ensures your assets are protected and efficiently transferred, reducing potential losses from taxes or legal complications. Diversifying your investments and maintaining a flexible withdrawal strategy also shield you from sequence‑of‑returns risk. Regularly reviewing and adjusting your plan keeps you aligned with changing market conditions and personal circumstances. Recognizing narcissistic traits in financial advisors or family members can help you avoid manipulation or undue influence over your financial decisions. Incorporating investment diversification strategies can further reduce vulnerability to market volatility. Developing a comprehensive understanding of Lifevest Advisors can guide you toward trusted resources and reputable investment options. Being aware of financial product features can help you choose the most suitable options for your retirement plan. Staying informed about cloud service outages and their impact can help you prepare contingency plans for financial disruptions. By integrating these tools—smart tax planning, thoughtful estate considerations, and adaptable strategies—you strengthen your financial resilience and increase the likelihood of achieving a secure, comfortable retirement.

Frequently Asked Questions

How Does Sequence-Of-Returns Risk Differ From Standard Market Risk?

Sequence-of-returns risk differs from standard market risk because it focuses on the timing of market volatility. You might face significant losses if poor returns happen early in your retirement, depleting your savings faster. Unlike general market risk, which is about overall volatility, sequence-of-returns risk emphasizes how investment timing impacts your ability to sustain withdrawals during downturns, making early market declines especially damaging to your retirement plans.

Can Sequence-Of-Returns Risk Be Fully Eliminated or Just Mitigated?

You can’t fully eliminate sequence-of-returns risk, but you can mitigate it. Consider using alternative investments and risk diversification strategies to reduce its impact. Diversifying your portfolio helps cushion against adverse market swings, especially during early retirement years. Additionally, incorporating alternative investments like real estate or bonds can stabilize returns. While you can’t completely remove this risk, proactive planning and diversification markedly improve your chances of maintaining financial stability.

What Role Does Asset Allocation Play in Reducing This Risk?

Asset allocation plays a vital role in reducing sequence-of-returns risk by implementing diversification strategies across various asset classes. You should regularly engage in asset rebalancing to maintain your desired allocation, especially after market fluctuations. This approach helps cushion against the impact of poor market sequences, ensuring your portfolio remains resilient and aligned with your retirement goals, ultimately minimizing the risk of early retirement setbacks.

Are There Specific Retirement Strategies Tailored to Sequence-Of-Returns Risk?

Yes, you can adopt strategies like a dynamic withdrawal plan to adjust spending based on market performance, helping manage sequence-of-returns risk. Incorporating tax-efficient strategies, such as Roth conversions or tax-loss harvesting, can also preserve your nest egg during downturns. These tailored approaches allow you to adapt your retirement plan proactively, reducing the impact of market volatility and keeping your retirement on track despite unpredictable market sequences.

How Frequently Should Retirees Review Their Portfolios for This Risk?

You should review your portfolio at least annually to monitor for sequence-of-returns risk. During these reviews, consider market timing and adjust your withdrawal strategies to minimize the impact of downturns. Regular checks help you stay aligned with your retirement goals, allowing you to rebalance investments or modify withdrawals if markets decline unexpectedly. This proactive approach guarantees you’re better positioned to weather volatile periods and maintain your financial stability.

Conclusion

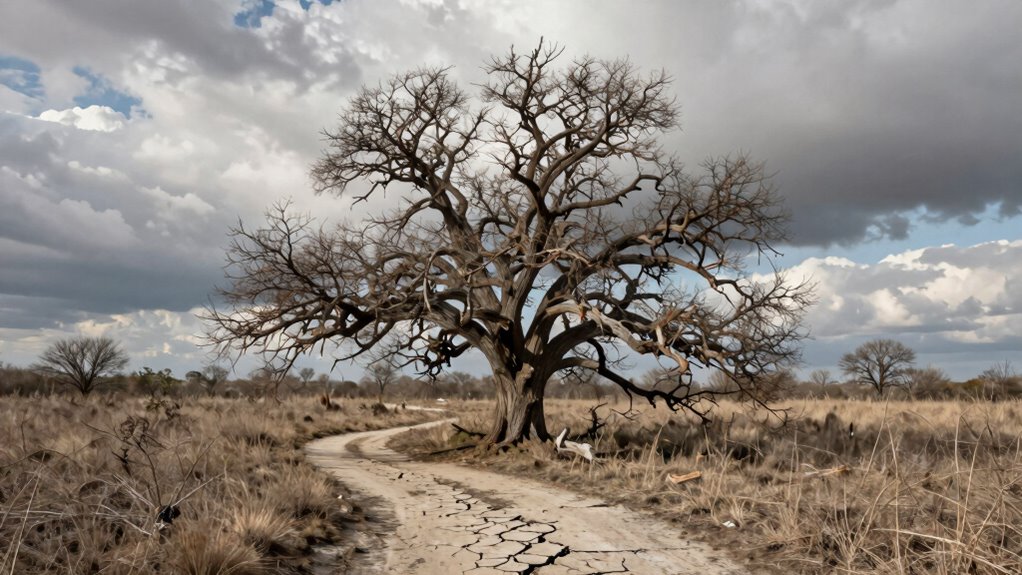

Think of your retirement savings as a delicate boat steering unpredictable waters. Sequence-of-returns risk is like sudden storms that can capsize your journey if you’re unprepared. By steering wisely—diversifying, adjusting withdrawals, and staying vigilant—you can weather the storms and keep your voyage steady. Remember, with the right strategies, you’ll anchor your dreams securely and sail peacefully into your golden years, no matter how turbulent the seas.