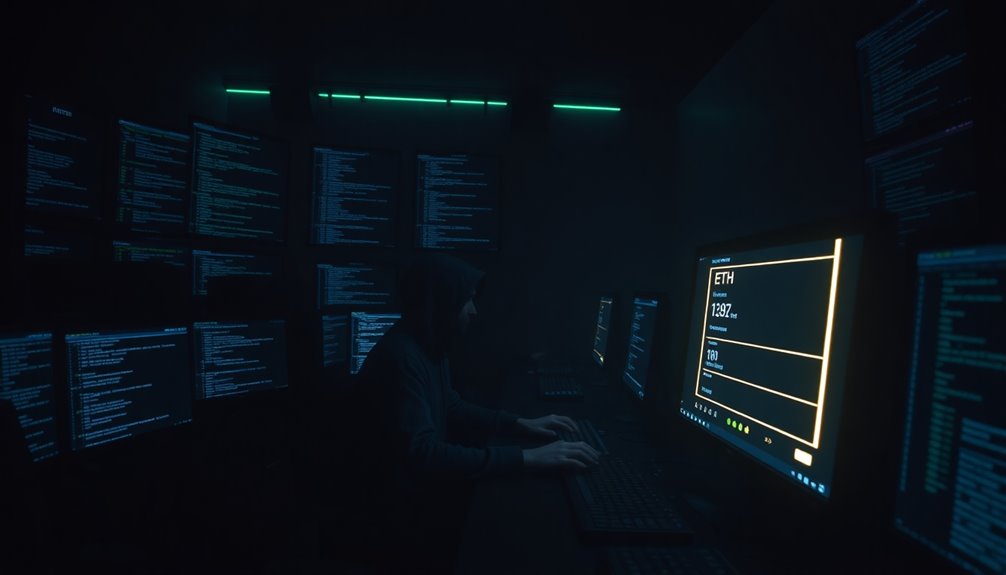

You're witnessing a complex web of cybercrime as hackers linked to North Korea's Lazarus Group launder a significant amount of Ethereum stolen in the Bybit breach. They're using advanced tactics to obscure the trail, from mixing services to cross-chain swaps. As the investigation unfolds, the challenge of tracing these funds becomes increasingly daunting. What implications does this have for future security measures in the crypto world?

In a shocking breach, hackers linked to North Korea's Lazarus Group have stolen approximately $1.5 billion in Ethereum and other assets from Bybit, marking the largest cryptocurrency theft in history. This incident not only highlights the vulnerabilities within wallet infrastructure but also raises urgent questions about security and risk management in the cryptocurrency space. The attack exploited a supply chain vulnerability, demonstrating a sophisticated approach to cybercrime that you can't ignore.

In the immediate aftermath, the financial impact was significant. Major cryptocurrencies, including Bitcoin and Ethereum, saw a decline in prices, leaving investors rattled. Regulatory bodies quickly reacted, calling for stricter regulations to enhance security across exchanges.

The cryptocurrency market faced a sharp decline, prompting urgent calls for enhanced security regulations across exchanges.

Bybit, facing the crisis head-on, secured emergency funding to replenish its reserves and launched a bounty program, offering up to 10% rewards for the recovery of stolen assets. They assured users that all client assets remained backed 1:1, providing some peace of mind amidst rising panic.

As the stolen funds began to move, it became clear that the hackers were actively laundering a significant fraction of the ETH. The initial transfers went to unidentified addresses, but the perpetrators didn't stop there. Portions of Ethereum were converted to Bitcoin and other tokens, complicating the tracing efforts.

They employed mixing services, routing over 5,000 ETH through the eXch mixer to obscure the transactions further. Cross-chain swaps using protocols like THORChain and ChainFlip allowed them to disperse the assets across numerous wallets, making tracking nearly impossible. The FBI attributed the theft to North Korea-linked hacking groups, specifically the Lazarus Group, raising alarms for international cooperation to block illicit transactions.

The FBI has attributed the hack to North Korea's Lazarus Group, which has a history of cybercrime aimed at financing the regime's nuclear weapons program. This incident showcases their advanced tactics in social engineering and laundering, raising alarms for international cooperation to block illicit transactions.

The cryptocurrency industry now faces heightened scrutiny regarding security vulnerabilities, particularly in third-party tools and interfaces. As Bybit and blockchain analysts work tirelessly to track the stolen funds, the industry collaborates to recover what can be salvaged.

The use of blockchain intelligence for forensic investigations has become crucial in this ongoing effort. The potential long-term effects on cryptocurrency market stability remain to be seen, but one thing is clear: the need for robust security measures has never been more urgent.