A one-page retirement plan simplifies your preparation by focusing on essential goals, savings, and lifestyle preferences. It helps you organize your finances, define clear priorities, and identify risks in just a few concise sections. Regular updates ensure your plan stays adaptable as your life changes. By keeping it straightforward and all-inclusive, you stay motivated and on track. Continue exploring, and you’ll discover how to create an effective, simple template that truly works for you.

Key Takeaways

- Focus on essential elements like goals, savings, investments, estate, and healthcare directives for a simple, comprehensive plan.

- Use clear, measurable objectives and regularly review to adapt to changing circumstances.

- Incorporate hobbies and social activities to stay motivated and engaged throughout the planning process.

- Organize all financial and estate documents in one accessible place for easy updates and reference.

- Keep the plan flexible, updating beneficiaries and strategies to reflect life changes and market conditions.

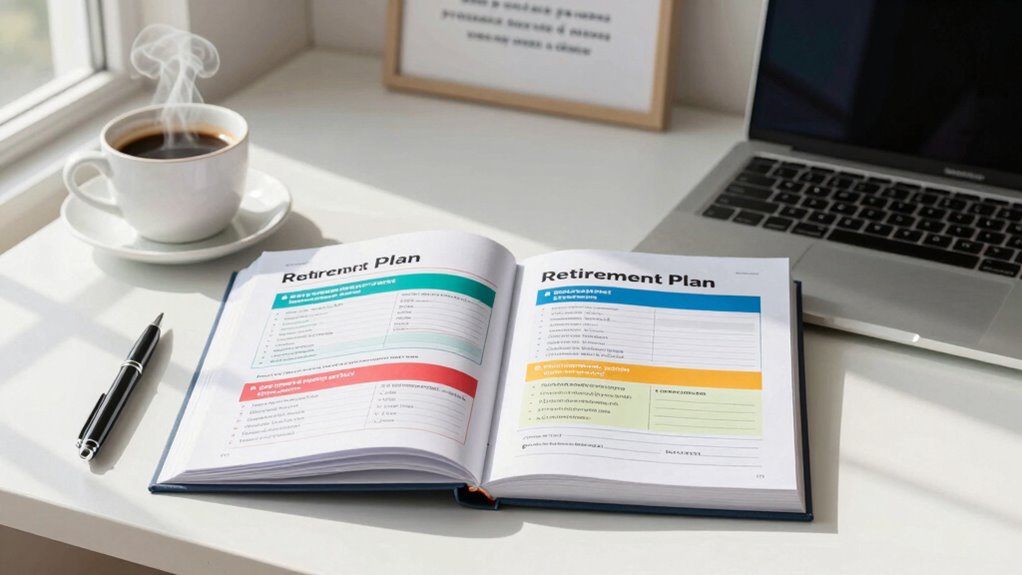

Why a Simple One-Page Retirement Plan Can Make Planning Easier

A simple one-page retirement plan simplifies the often overwhelming process of financial planning. It helps you focus on essential elements like estate planning and healthcare directives, making complex decisions easier to manage. With a clear, concise document, you avoid the stress of scattered paperwork or missed details. This approach guarantees your wishes are documented, such as who will handle your estate or make healthcare decisions if you’re unable. Having everything in one place gives you peace of mind and makes it easier to communicate your intentions to loved ones and professionals. By keeping your plan straightforward, you’re more likely to review and update it regularly, ensuring it remains aligned with your evolving needs and priorities. Additionally, a streamlined plan can incorporate important considerations like asset allocation and project timelines, which are essential for effective retirement planning. Incorporating European cloud solutions can also enhance the security and accessibility of your documents, ensuring your plan remains protected and easy to update from anywhere.

How to Clearly Define Your Retirement Goals and Priorities

Start by identifying your financial goals to determine what you need to save and invest. Then, prioritize your lifestyle desires to focus on what truly matters most in retirement. Incorporating environmental considerations such as wave and wind factors can help you better understand environmental factors that might influence your retirement planning. Recognizing renewable energy sources can also contribute to a more sustainable and resilient financial plan. Being aware of climate change impacts can help you anticipate potential environmental challenges that may affect your long-term plans. Additionally, understanding the importance of lifestyle for longevity can guide you in making choices that promote long-term health and happiness.

Identify Financial Goals

How you define your financial goals shapes your entire retirement plan. Clear goals help you prioritize savings, investments, and estate planning, ensuring your future is secure. To set meaningful objectives, consider:

- The lifestyle you want and the costs involved

- Your plans for estate planning and passing assets

- How tax strategies can maximize your savings

- The timeline for reaching specific financial milestones

- Your risk tolerance and investment preferences

- Incorporating Free Floating elements into your plan can also help you adapt to unexpected changes and maintain flexibility. Understanding Gold IRA Markets can provide valuable insight into diversifying your investment portfolio to support your goals, especially as the Law of Attraction emphasizes aligning your mindset with your financial aspirations. Additionally, reviewing pet care essentials can ensure your plans include provisions for your pets’ well-being during retirement, offering peace of mind for your entire family. Being aware of emerging trends in electric bikes can also inspire alternative transportation options that might impact your savings and lifestyle choices in retirement planning.

Prioritize Lifestyle Desires

Once you’ve identified your financial goals, the next step is to clarify your lifestyle desires for retirement. Think about what activities, environments, and daily routines will bring you fulfillment. This includes considering your estate planning needs to ensure your assets are aligned with your wishes and healthcare preferences to maintain your quality of life. Prioritizing these desires helps you allocate resources effectively and avoid unnecessary stress later. Be specific about your ideal retirement—whether it’s traveling, volunteering, or relaxing at home. Understanding these priorities guides your financial planning and decision-making, ensuring your retirement reflects your true aspirations. Incorporating thermal behavior of your chosen activities can help optimize your daily routines and comfort levels. Remember, a clear vision of your lifestyle sets the foundation for a fulfilling and well-prepared retirement.

Set Realistic Timelines

To set realistic timelines for your retirement, you need to establish specific milestones that align with your financial goals and lifestyle desires. Effective milestone planning helps you track progress and adjust your plans as needed. Consider these key points:

- Break your retirement into manageable phases with clear target dates

- Prioritize goals based on importance and feasibility

- Account for potential delays or setbacks in your timelines

- Review and update your milestone planning regularly

- Balance your ideal retirement age with financial readiness

Organizing Your Savings and Investment Strategies on One Page

Creating a one-page overview of your savings and investment strategies helps you stay focused and organized. Start by listing your current accounts, such as retirement funds, IRAs, and taxable investment accounts. Include your target allocations and contribution plans. Incorporate tax planning strategies to maximize benefits and minimize liabilities, like tax-advantaged accounts or tax-efficient investments. Also, consider estate considerations, such as beneficiary designations and estate planning tools, to ensure your assets are protected and transferred smoothly. Keep this overview simple and actionable, focusing on what you need to review regularly. This approach helps you maintain clarity on your financial progress and ensures your strategies align with your long-term goals. Staying organized on one page makes adjustments easier and keeps your plan practical. Regularly reviewing your investment allocations helps ensure your portfolio remains aligned with your risk tolerance and goals.

Key Questions to Ask When Creating Your Retirement Strategy

To create an effective retirement strategy, you need to ask yourself some key questions. Are your financial goals clear, and do they match your current lifestyle? Understanding your risk tolerance and planning income replacement will help you build a plan that’s realistic and achievable. Additionally, assessing your credit score can influence your ability to secure favorable loans or financing options in the future. Knowing your financial literacy level can further empower you to make informed decisions about your retirement. Being aware of affiliate disclosures and privacy policies can also help you protect your personal information while researching retirement options. Exploring water-related activities, such as aquatic exercise, can contribute to your overall well-being and prepare you physically for retirement. Incorporating piercings into your personal expression or self-care routine can also enhance your confidence during this phase of life.

Financial Goals Clarity

Clarifying your financial goals is a crucial first step in developing a solid retirement strategy. Knowing what you want to achieve helps guide decisions on savings, estate planning, and tax optimization. Ask yourself: How much income will I need? What lifestyle do I envision? Do I want to leave an inheritance? When do I plan to retire? What risks am I willing to accept? These questions ensure your plan aligns with your values and priorities. Clear goals also help you identify the right strategies for estate planning and tax efficiency, maximizing your resources. Without clarity, you risk misallocating funds or missing opportunities to safeguard your future and loved ones. Keep your objectives specific, measurable, and adaptable to stay focused and motivated.

Investment Risk Tolerance

Understanding your investment risk tolerance is essential because it determines how comfortably you can handle market fluctuations and downturns. If you’re willing to accept higher risks, you might pursue more aggressive growth strategies that could maximize your retirement savings. Conversely, a lower risk tolerance suggests a preference for stability and preservation of capital. Your risk level also influences your estate planning and tax planning strategies, as riskier investments can complicate estate transfers or create tax implications. Knowing your comfort with risk helps you craft a balanced approach that aligns with your overall retirement goals, ensuring you’re neither overly cautious nor too bold. Clarifying this tolerance allows you to select investments that suit your personal comfort level and long-term financial security. Additionally, understanding your risk tolerance can help you identify investment strategies that promote emotional resilience during market downturns, especially when considering the modern farmhouse decor trends that emphasize sustainable and authentic choices. Recognizing your risk capacity is crucial in adapting your portfolio to withstand market volatility without unnecessary panic or overexposure, and being aware of market fluctuations can help you maintain a steady course toward your retirement objectives.

Income Replacement Strategies

How can you guarantee your retirement income keeps pace with your expenses? By developing robust income replacement strategies, you ensure financial stability. Consider diversifying sources like Social Security, pensions, and savings. Focus on estate planning to pass on assets efficiently and preserve wealth. Maximize tax efficiency by choosing tax-advantaged accounts and withdrawal strategies. Regularly review your plan to adapt to changing market conditions and personal needs. Think about longevity and healthcare costs to avoid surprises. Incorporate income streams that can be adjusted or delayed if needed. Keep in mind that a well-structured plan reduces stress and secures your lifestyle. Balancing estate planning and tax efficiency helps you leave a lasting legacy while maintaining a steady income flow during retirement.

Tips for Keeping Your Retirement Plan Updated and Flexible

To guarantee your retirement plan remains effective as your circumstances change, it’s essential to review and update it regularly. Life events like marriage, divorce, or new dependents can impact your estate planning and healthcare directives, so adjustments are necessary. Schedule annual reviews to ensure your beneficiaries are current and your estate plan aligns with your wishes. Keep your documents accessible and clearly organized. Flexibility also means being open to revising your investment strategies or retirement goals if market conditions or personal priorities shift. Staying proactive helps you avoid surprises and ensures your plan reflects your evolving needs. Regular updates give you peace of mind, knowing your retirement plan stays aligned with your life’s changes and that your estate and healthcare directives are up to date.

Common Mistakes to Avoid With Your Simple Retirement Plan

Even the best retirement plans can falter if you fall into common pitfalls. One mistake is neglecting estate planning, which can cause confusion or delays for your heirs. Overlooking health considerations can leave you unprepared for medical expenses or long-term care. Failing to update your plan regularly may mean missing out on new opportunities or changes in your financial situation. Ignoring inflation risks reducing your purchasing power over time. Ultimately, not setting clear, achievable goals can make your plan feel overwhelming or unmanageable. To avoid these errors, regularly review your estate plan, incorporate health considerations, adjust for inflation, set realistic milestones, and stay flexible. A thoughtful approach helps ensure your simple retirement plan remains effective and aligned with your evolving needs.

Using Your One-Page Retirement Plan to Stay Motivated and Track Progress

Your one-page retirement plan isn’t just a static document; it’s a dynamic tool that keeps you motivated and on track. Regularly reviewing your plan helps you celebrate progress and identify areas needing adjustment. Incorporate retirement hobbies into your routine to stay excited about your goals, whether it’s gardening, traveling, or learning new skills. Social engagement is also essential; connecting with friends and community groups sustains your enthusiasm and provides support. Use your plan to set small milestones, and track your achievements weekly or monthly. This ongoing process keeps your motivation high and ensures you remain focused on your vision. By actively engaging with your plan, you turn retirement planning from a chore into an inspiring journey toward your ideal future.

Frequently Asked Questions

Can a One-Page Retirement Plan Accommodate Complex Financial Situations?

A one-page retirement plan can handle some financial complexity, but it might not fully capture intricate details. You can include key investment strategies and prioritize your goals, yet complex situations like multiple income streams or unique estate plans could require additional documentation. To guarantee your plan remains effective, consider updating it regularly and consulting a financial advisor for nuanced advice tailored to your specific circumstances.

How Often Should I Review and Revise My Retirement Plan?

You should review your retirement plan at least once a year, like tending a garden to keep it healthy. Life changes, investment strategies, and estate planning needs evolve, so regular updates make certain you’re on track. If major events occur—like a new job, marriage, or purchase—you should revise it sooner. Staying proactive helps you adapt, stay aligned with your goals, and grow your retirement nest egg securely.

Is a One-Page Plan Suitable for Self-Employed Individuals?

Yes, a one-page plan works well for self-employed individuals by simplifying your retirement savings strategy. It helps you focus on key self-employed strategies like setting clear goals, tracking contributions, and adjusting for income fluctuations. With a concise plan, you stay motivated and organized, ensuring your retirement savings stay on track. Regular reviews and revisions keep your plan aligned with changing income and goals, making retirement planning less overwhelming.

What Tools or Software Can Help Create My One-Page Retirement Plan?

Imagine holding a clear, colorful map that guides your financial journey—this is what financial planning tools and retirement software offer. Programs like Mint, Personal Capital, or Excel templates simplify your process, helping you craft a concise, effective one-page retirement plan. These tools track your goals, investments, and savings, making it easier to visualize progress and adjust strategies, ensuring your retirement roadmap stays on course.

How Do I Balance Risk and Growth in a Simple Retirement Plan?

You balance risk and growth by evaluating your risk tolerance first, understanding how much volatility you’re comfortable with. Incorporate diversification strategies by spreading investments across different asset classes, which helps manage risk while aiming for growth. Regularly review your plan, adjusting investments as your goals or risk appetite change. This proactive approach keeps your retirement plan aligned with your comfort level and growth objectives, ensuring a sustainable, balanced strategy.

Conclusion

A one-page retirement plan keeps things simple and focused, making it easier to stay on track. Did you know that 60% of retirees regret not starting to save earlier? By keeping your plan clear and up-to-date, you’ll boost your confidence and motivation. Remember, a straightforward plan isn’t just easier to create—it’s your best tool to turn retirement dreams into reality. Stay flexible, review regularly, and keep moving forward—you’ve got this!